Traders tend to seek methods for more accurate forecasting of price actions in order to make successful trades. It may be difficult to forecast market direction from previous price actions, and most indicators do not quite offer accurate forecasts.

There are a wide range of indicators available on the TradingView platform, but one indicator excels in predicting the future price action with uncanny accuracy – the “Next Pivot” indicator.

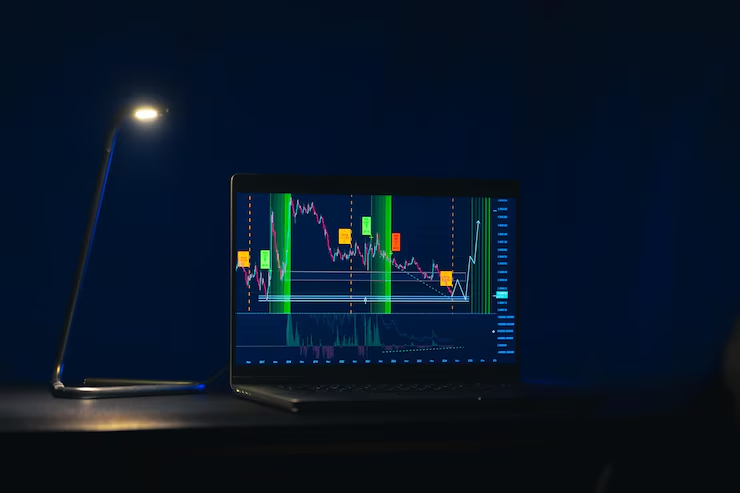

Through the use of the “Next Pivot” indicator with other strategy aids such as the SSL Hybrid and Volume Oscillator, traders are able to design a robust, consistent strategy that not only foretells the direction of price action but also enhances the success of trades.

What is the “Next Pivot” Indicator?

The “Next Pivot” indicator is a product on the TradingView platform that predicts future price movement in a trading chart. When applied, it displays two lines: a white line, which is the projection of the exact price action, and a green line, which shows a general price movement forecast. The tool is programmed to find price movements most likely to happen from past data, based on the assumption that “what happened in the past is likely to happen in the future.”

The “Next Pivot” indicator is based on price history analysis, looking as far back as 20 (or more, depending on settings) prior candles to look for similar shapes. When the indicator finds an extremely similar shape in the past, it accurately foretells future price movement.

How Does the “Next Pivot” Indicator Work?

The key to the “Next Pivot” indicator is its parameters, and more importantly the correlated length parameter. This is because this parameter will decide how many candles the indicator will consider. By default, it considers the last 20 candles, going back into the past charts for the same patterns in the price action there that could be the same at the present time.

The indicator subsequently displays the traders this information on the chart, providing them with an estimated price movement that is extremely accurate. As accurate as it is, however, the “Next Pivot” indicator used in isolation can be risky to employ. It should be used in conjunction with other indicators so that trades are executed based on a balanced analysis.

How to Optimize the “Next Pivot” Indicator Strategy?

To get the most out of the “Next Pivot” indicator, a multiple-indicator strategy might be utilized. Here’s how:

1. Add SSL Hybrid Indicator

SSL Hybrid indicator eliminates false signals. Add it to your chart and set its settings as follows:

- Set SSL1 baseline length to 200.

- Modify the baseline type to McKinley, which is one of the types of moving average that is tailored to follow market trends more efficiently than regular moving averages.

2. Add Volume Oscillator

Volume Oscillator is a vital indicator to verify the strength of price movements. By adding this and tweaking the settings to improve its visibility, you ensure that the forecasted price movements have sufficient volume to validate them. For example:

- Expect the volume oscillator to be higher than the zero line, validating the strength of the trend.

Once these indicators are plotted, your chart will be more accurate for trading decisions. But that’s not all. Success depends on the way you trade using these projections.

The Ultimate Trading Strategy

Let’s discuss the trading strategy using the “Next Pivot” indicator with the SSL Hybrid and Volume Oscillator.

For a Long Trade (Buy):

Condition 1: The white projection line must be moving upwards.

Condition 2: Both the bars and the moving average baseline should be blue.

Condition 3: The volume oscillator should be above the zero line.

If all these conditions align, it’s time to set your trade. Here’s how to manage it:

- Stop Loss: Set it right below the most recent low.

- Take Profit: Set it at a recent high.

This setup provides a solid framework for entering a long trade, maximizing your chances of success.

For a Short Trade (Sell):

Condition 1: The white projection line must be declining.

Condition 2: Both the bars and the moving average baseline must be red.

Condition 3: The volume oscillator must still be above the zero line.

For a short trade, do the following:

- Stop Loss: Place it just above the latest high.

- Take Profit: Place it at a recent low.

Common Problem and How to Solve It

One of the difficulties of this strategy is reaching a point where the projection line indicates a desirable entry but price action may not cooperate with stop loss and take profit points.

Example: Supposing all the conditions for a long trade are fulfilled – the projection line is rising, the bars and moving average line are blue, and the oscillator of the volume is higher than the zero line. But if you look closer at the projection line, you notice that it might reach your stop loss before the take profit target. In this case, do not make the trade. This forward-looking analysis may rescue you from a loss that could have arisen.

How This Strategy Works in Practice

To demonstrate the effectiveness of this strategy, consider the case of a trader using Hankotrade as their broker. With a $100,000 deposit, this trader successfully profited $28,000 using the “Next Pivot” indicator strategy. The integration of TradingView with Hankotrade’s advanced features, such as fast execution and lower commissions, significantly boosts the potential for profitable trades.

Conclusion

The “Next Pivot” indicator is a phenomenal tool with the ability to forecast future price action with impressive accuracy. However, as any trading tool, it performs at its best when combined with other dependable indicators like the SSL Hybrid and Volume Oscillator. Using the above strategy, traders will be able to maximize their winning chances and trade with increased confidence.

If you wish to experiment with this strategy yourself, don’t forget to create your TradingView account, go through the process of adding the indicators, and backtest the system in a demo setup before. TradingView has an excellent platform to practice these tools, and once you get a good idea about how they function as a group, you will be able to forecast market activity better and make more informed trades.