If you’re a trader who has been following the standard Heiken Ashi to inform your trades, you may be missing an important point.

The Heiken Ashi, popular for its smoothing of price action and noise reduction, isn’t an ideal tool. It frequently does not capture important information, such as price patterns, support, and resistance areas, and can generate false signals. Consequently, the traders might end up entering and closing trades at the incorrect times, losing out on potential gains.

Suppose there was a method to utilize the Heiken Ashi’s smoothing feature while also gaining access to important price data? Well, I’ve discovered a solution that is revolutionary. By upgrading the Heiken Ashi with a new, better version of the indicator, you can enjoy the best of both worlds.

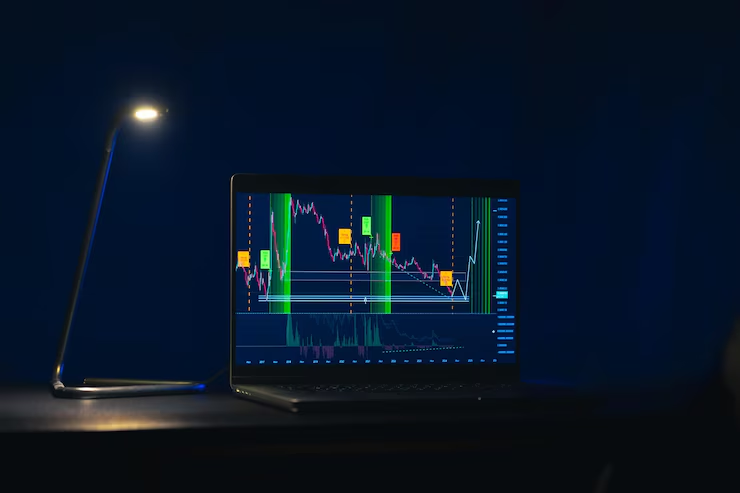

This new indicator provides you with not only the Heiken Ashi’s smoothed-out price action but also overlays the candlestick chart with it, so you get to view the old price action and the smoothed-out trend simultaneously. This assists in preventing false signals and easy prediction of market changes.

This new “Smoothed Heiken Ashi” indicator is infinitely superior to the original Heiken Ashi. Backtested and shown to be twice as profitable, it gives a much better understanding of market trends. In this article, we will demonstrate how this new indicator operates, how to implement it, and how to design a successful trade strategy.

Why the Original Heiken Ashi Doesn’t Cut It

The traditional Heiken Ashi has been popular with traders because it can eliminate the noise from normal candlesticks and give a clearer view of the general trend. However, it has serious flaws. For instance, it does not provide the live price action, and therefore it does not include vital information like chart patterns, support, and resistance.

This is where the new upgraded form of the Heiken Ashi really shines. Instead of substituting candlesticks entirely, this new indicator places Heiken Ashi over them. This allows you to continue viewing the live price action while taking advantage of the smoothing effect that Heiken Ashi offers.

What Makes the Smoothed Heiken Ashi Indicator So Effective?

The reason why this Smoothed Heiken Ashi indicator is so powerful is that it removes the disadvantage of the original Heiken Ashi without sacrificing the benefits. It lets you view both the candlesticks and the smoothed trend at the same time, giving you a better sense of the market. This enhancement makes it much more difficult to get faked out by false signals, which is one of the main issues with the original Heiken Ashi.

For instance, on a regular chart with the Heiken Ashi, you may have some green candles indicating an uptrend, only to have red candles appearing out of nowhere. The red candles have the potential to make you close the trade early or miss out on the most profitable opportunities. The Smoothed Heiken Ashi reduces such fakeouts to a great extent and gives you a much neater signal to ride the trend longer and profitably.

How to Use the Smoothed Heiken Ashi Indicator

Now that we understand why this indicator is so great, let’s discuss how to utilize it correctly in your trading. To begin with, you’ll have to have a platform like TradingView, where you can merely access and implement this upgraded indicator.

Add the Indicator to Your Chart:

You can head over to TradingView’s Indicators tab and look for “Smoothed Heiken Ashi” by jackvmk.

Once added, adjust the settings based on your trading style. If you’re a short-term trader, try settings of 5 and 5 for better analysis of short-term price movements. For long-term traders, set it to 20 and 20 to capture broader trends. For this tutorial, we’ll use the default settings of 10 and 10.

Interpret the Indicator:

Green candles signal an uptrend, while red candles indicate a downtrend.

This is the reason that indicator is so well-suited for detecting trend reversals. As an example, if you are in a downtrend market and notice the color changing to green candles, it’s a cue that perhaps there is an underway market reversal.

A Secret Trick for Identifying Trend Strength

One of the strongest aspects of the Smoothed Heiken Ashi indicator is the candle size. You can utilize the Heiken Ashi candle size as a determinant of market vigor. Here is how:

Large Candles:

If you observe that the Heiken Ashi candles are increasingly larger, what it indicates is that the market is gaining pace in the direction it is trending.

Decreasing Candles:

On the contrary, if candles are decreasing in size, this is a signal that the market might be getting weaker and will be preparing itself for a possible reversal.

By tracking these changes in candle size, you can identify changes in momentum much earlier and take advantage of them.

Successful Strategy with the Smoothed Heiken Ashi Indicator

Even though the Smoothed Heiken Ashi is reliable in signaling, you should not go into the trade blindly without other analysis. It must be used together with trend identification and price action for a more powerful strategy. Here is a step-by-step method of achieving greater profits:

Find a Strong Trend:

Look for a downtrend indicated by red Heiken Ashi candles that are progressively larger. This shows the market is in a strong downtrend.

Wait for a Reversal Signal:

As the candles start to get smaller, observe a change from red to green. This shows the market has the potential to reverse.

Verify with a Pullback:

Wait for the price to pull back to the Heiken Ashi candles after the reversal signal. This is where you will have your entry point.

Enter the Trade:

After you see a green candle verifying the reversal, enter your trade. Set your stop loss at the low of the Heiken Ashi candles, and aim for a 1.5 risk-to-reward ratio on your take profit.

Partial Profit-Taking:

When the price hits your take profit target, sell half of your position for guaranteed profits. Move your stop loss to break-even, and only close your trade completely after the Heiken Ashi has become red.

This technique fuses the strength of the Smoothed Heiken Ashi with traditional risk management principles to enhance your profit potential without taking too much risk.

Conclusion

The Smoothed Heiken Ashi indicator is a revolutionary tool for traders seeking to upgrade their strategy and gain more accurate trades. By superimposing the Heiken Ashi over conventional candlesticks, this new-age tool enables traders to have the best of both worlds—smoothing the noise out but still delivering the essential information required for successful trading.

By applying this indicator with the following strategies, you can decrease false signals and be better able to forecast market activity. Try it on your own charts and begin experiencing better, more profitable outcomes today.