The stock market is a dynamic environment. The investor and trader are confronted by the question of which opportunity to take advantage of amid continuously changing circumstances. While others succeed, others are plagued by trying to determine the best methods to employ, particularly when confronted by the unpredictability of bull and bear markets.

The challenge is to know what stocks to invest in, how to get in and out, and when to change strategy to pursue the fluctuations of the market. That is where Takeshi Kotegawa’s amazing trading experience comes in.

Takeshi Kotegawa’s Strategy

Takeshi Kotegawa is perhaps the most successful intraday traders to have emerged into the limelight in the early 2000s, converting a modest $13,000 investment into a whopping $153 million in a mere eight years. His tale is not just interesting but also a pointer to how an advanced trading strategy, if employed with accuracy, can result in colossal wealth.

Kotegawa’s strategy, which involves spotting stocks in long-term downtrends and making profits out of short-term reversals, can be a winner for anyone who wishes to emulate his success. Using strategic market analysis, smart stock selection, and optimal usage of technical indicators, Kotegawa capitalized on astronomical profits, achieving a return of 11,700%. But what was his success secret?

How to Apply Takeshi Kotegawa’s Strategy to Succeed in the Market

Learning Kotegawa’s Trading Strategy

In a bid to emulate Takeshi Kotegawa’s success, learning the ideas behind his trading method is essential. Kotegawa’s main objective was clearly defined: he aimed to find stocks that were in long-term declines so that he could catch short-term reversals.

Basically, he sought to get into the “bottom” of a stock’s bear market so that he could profit on an impending bounce or turnaround. This required an intimate acquaintance with market situations, good timing, and above all, utilizing technical analysis for establishing the most appropriate entry and exit points.

Important Conditions for Pinpointing Stocks

Kotegawa’s investment technique worked best when there were bear markets, as there were more chances to find undervalued stocks that had been oversold. He used to search for stocks that had fallen at least 20% from their 25-day moving average, the 35% difference being even safer.

The idea was to purchase when shares had fallen quite a bit with the hope that they would rebound. But it wasn’t number-crunching only—it was interpreting the market conditions as a whole and adapting his strategy in response. For instance, in a bear market he would seek wider price gaps, while in a bull market narrower gaps were called for.

The Role of Market Sentiment

Kotegawa did not trade alone. He examined the market mood and industry performance cautiously before trading. To determine the market mood, he used a mix of fundamental analysis, examining bigger trends on large indices such as the S&P 500, and industry-level trends to maximize his strategy.

It was essential to understand the general direction of the market since stocks in those sectors that traded most erratically, like technology or biotechnology, had varied entry requirements relative to more conservative sectors like the utilities. This flexible style is one of the hallmark characteristics of his method, enabling him to modify his trades according to prevailing conditions.

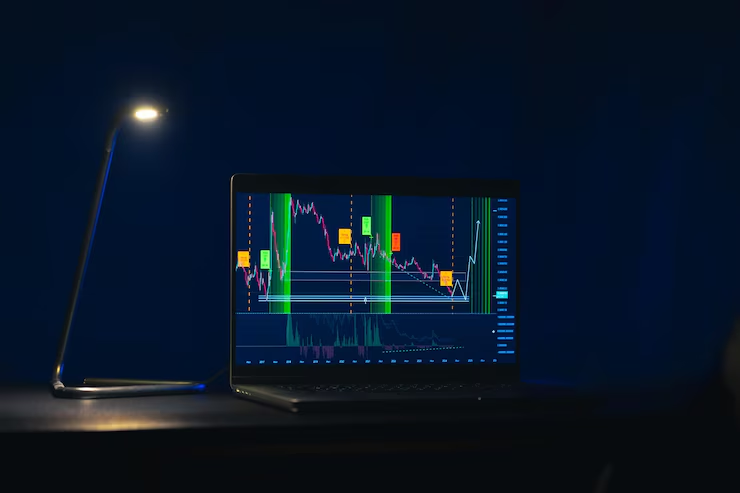

Technical Indicators and Chart Setup

Kotegawa’s system heavily depended on technical indicators like the Exponential Moving Average (EMA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). Here’s how you can use them:

Exponential Moving Average (EMA): Place the EMA at a 25-period moving average. The distance from the price and the EMA shows whether or not a stock is overbought in the current trend.

Relative Strength Index (RSI): This works to verify that a stock is oversold or overbought. Kotegawa would place RSI so that he can be sure that the stock was in an oversold state prior to entering into a trade.

MACD: This indicator of momentum helps Kotegawa confirm a potential reversal of trend. He looked for MACD histograms to turn green as a sign that the market was becoming bullish.

Finding the Right Stocks

Once the criteria are set as indicators, you need a place to filter the stocks that meet the criteria. Using a stock screener from platforms like TradingView, you can filter for stocks under the conditions of drop in price more than 20%, and the price below 20-day EMA. After narrowing down the list of targets, you may identify stocks suited to Kotegawa’s style.

Entry Strategy: Awaiting the Appropriate Time

Once a proper stock was chosen, Kotegawa would anticipate the stock falling to a key level of support. It was crucial to select the most important levels of support, noting only robust levels on the chart. If a share came to such levels, Kotegawa would watch action on lower time frames (for example, the 15-minute chart) before looking for reversal signals.

He would search for confirmation that the price was beginning to rebound at levels of support, with signals like RSI indicating oversold and the MACD indicating positive momentum. Only when these conditions were met would he enter.

Risk Management: Dynamic Take-Profit and Stop-Loss

Risk management was included in Kotegawa’s plan. He would vary his stop-loss and take-profit levels based on the market condition. During bear markets, he would seek lower take-profit levels, while during bull markets, higher ones.

He would typically place his stop-loss just below the previous low so that his risk would be minimized in case the trade turned against him.

Conclusion

Takeshi Kotegawa’s approach to trading is not an instant gratification or a “get-rich-quick” plan; it’s a question of following a disciplined, systematic method of trading. By reading the mood of the market, using the right technical indicators, and managing risk, Kotegawa transformed an initial investment of $13,000 into $153 million in eight years.

To be successful with this strategy, precision and patience are the watchwords. Choose the right stocks, gauge the market mood, and use indicators to validate entry points. Risk management is critical—adjust your stop-loss and take-profit levels according to the market situation. Adhering to these principles, you will be able to maximize your trading success and even match the type of dazzling returns Kotegawa has posted.

Whether you’re trading in a bear or bull market, Takeshi’s approach teaches us that adaptability, patience, and the right technical setup are key to navigating the markets successfully. So, gear up, refine your trading strategy, and start applying these techniques to see how they work for you.